Adding a Sub-Merchant

The Add a Sub-Merchant Page of the PayFac Portal is used for both creating the initial Legal Entity request (see Creating a New Legal Entity Request) and for adding additional sub-merchants after the initial legal entity request is created and approved.

To add a sub-merchant to an existing legal entity:

-

From the iQ Bar of the Merchant Onboarding Page, click the Operations icon and select PayFac Portal.

-

Select Add Sub-Merchant. The Add Sub-Merchant screen appears, as shown in the following figure.

-

Enter the appropriate information in each of the fields as listed in the table below. Required fields are marked with a red asterisk (*).

If the legal entity was previously approved, choose the desired EIN/Tax ID from the drop-down list. Legal entity fields are then pre-populated with the previously-approved legal entity information.

-

Click Add. A confirmation message appears stating that the legal entity was created and provides one of the following:

-

Instructions to correct missing or incorrect information (if any)

-

A new Sub-Merchant Id number

-

A message stating that the sub-merchant is in a non-approved state

If more than three (3) users attempt to enter or edit sub-merchants simultaneously, the Portal displays an error message. Resubmit as necessary.

-

-

If an internal error occurs when trying to add or edit a sub-merchant, the Portal displays the View Sub-Merchant screen. Review the submission and make corrections (e.g., if you are configuring for Amex OptBlue, but 'Amex Acquired = No' is selected). Click Resubmit to re-try the submission.

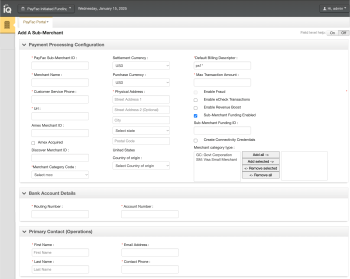

Add a Sub-Merchant Screen:

Payment Processing Configuration, Bank Account Details, Primary Contact Panels

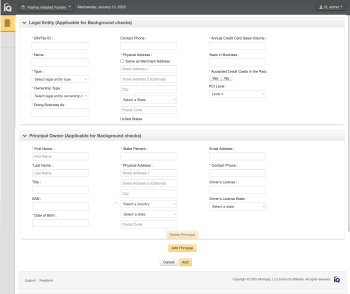

Add a Sub-Merchant Screen: Legal Entity and Principal Owner Panels

The table below describes all the fields in the Add a Sub-Merchant screen.

Add a Sub-Merchant Field Descriptions

|

Panel |

Field |

Description |

|---|---|---|

|

Payment Processing Configuration |

PayFac Sub-Merchant ID |

The unique identifier that your organization has assigned for this sub-merchant. |

|

Merchant Name |

The name of the sub-merchant, as known by customers. Do not use the paste function when entering data in this field; it may result in a "Disallowed Character" error. |

|

|

Customer Service Phone |

The customer service number for this sub-merchant, without hyphens. This is shown on the consumer’s statement if a value was not sent with the transaction. |

|

|

URL |

The URL/website for this sub-merchant, for example, ‘somecompany.com’. The domain name (after the '.') must be at least two (2) characters and can be more than six (6) characters. For example: Incorrect URLs: |

|

|

Amex Merchant ID |

The Merchant ID provided by American Express (only complete this field if the sub-merchant is Amex ESA/Conveyed). |

|

|

Amex Acquired |

Indicates whether or not this sub-merchant is designated as an American Express OptBlue merchant (Worldpay is acquiring the transactions). Do not check this box if the sub-merchant is Amex ESA/Conveyed (has a direct relationship with and settles funds directly to your organization). |

|

|

Amex Seller ID |

The unique identifier for this sub-merchant returned by Worldpay (read only). This is assigned even when Amex is not a method of payment. |

|

|

Discover Merchant ID |

The Merchant ID provided by Discover. Required if Discover has a direct relationship with you and settles the funds directly to you. |

|

|

Merchant Category Code |

The Merchant Category Code (MCC) for this sub-merchant. Your organization has been approved for the list of MCCs provided. |

|

|

Tax Authority |

The Tax Authority (taxing body) for which this sub-merchant collects tax payments. This field is required and only seen if the sub-merchant’s MCC is 9311 (‘Tax Payments - Government Agencies’). |

|

|

Tax Authority State |

The state associated with the Tax Authority listed above. This field is required if the sub-merchant’s MCC is 9311 (‘Tax Payments - Government Agencies’). |

|

|

Settlement Currency |

The settlement currency used by this sub- merchant. |

|

|

Purchase Currency |

The purchase currency of this sub-merchant (USD, unless this merchant settles outside of the US). |

|

|

Payment Processing Configuration (continued)

|

Address (includes Street Address 1 & 2, City, State/Province, Postal Code, and Country) |

The street address of this sub-merchant. P.O. boxes are not allowed. |

|

Country of Origin |

Indicates the country of origin, a required field when the Merchant Category Code (MCC) is associated with a government-controlled legal entity (MCCs 9211, 9222, 9311, 9402, 9405, and 9406). You must use the drop down to select, even if the country is listed in Address field above. |

|

|

Billing Descriptor Prefix |

The billing descriptor prefix for this sub-merchant. The prefix must:

If your organization has established a specific billing descriptor prefix, this field may be pre-populated with the prefix. |

|

|

Default Billing Descriptor |

The default billing descriptor for this sub-merchant, if the billing descriptor value was not sent with the transaction. This defines the text shown on the consumer’s billing statement. Limited to 25 total characters (your organization's hard-coded prefix plus the Descriptor). Do not change this value in sub-merchant updates if an authorization transaction has already been submitted and not yet captured or settled. |

|

|

Max Transaction Amount |

The maximum transaction amount (in the purchase currency) allowed on a single transaction submitted by this sub-merchant. Supply the value in cents without a decimal point (for example, a value of ‘50000’ = $500.00). A maximum of 10 digits is allowed. |

|

|

Enable Fraud |

Indicates whether this sub-merchant should be enabled for FraudSight or fraud filters. |

|

|

Enable eCheck Transactions |

Indicates whether this sub-merchant will be enabled for eCheck Transactions (only seen if your organization is enabled for eCheck payment type). If checked, you must complete the following fields:

|

|

|

Enable Revenue Boost |

Indicates whether to enable this sub-merchant for Revenue Boost (only seen if your organization is enabled for Revenue Boost). |

|

|

Payment Processing Configuration (continued)

|

Sub-Merchant Funding Enabled |

Indicates whether to enable this sub-merchant for Sub-merchant Funding, either Managed Payout or Dynamic Payout. For Managed Payout-configured sub-merchants:

For Dynamic Payout funding sub-merchants, the checkbox is automatically selected. Complete the Sub-Merchant Funding ID field, described next. For sub-merchants with standard funding, this field is disabled and unchecked. |

|

Sub-Merchant Funding ID |

The unique identifier used to designate this sub-merchant in funding instructions (Dynamic Payout). Enter one of these values:

This field is only seen if this sub-merchant is configured for Dynamic Payout funding. |

|

|

Create Connectivity Credentials |

Whether our system should create login credentials for this sub-merchant (username, password, and PayPage ID, if necessary). |

|

|

Merchant Category Type |

Identifies whether this sub-merchant is one of the following. Click the arrows to add or remove the appropriate type to and from the selection box.

|

|

|

Payment Type Processing Status |

Indicates the status of payment processing this sub-merchant can perform using Visa, Mastercard, Discover, American Express and/or electronic check payment types. The default/initial boarding status is 'Deposits and Refunds.' For existing sub-merchant updates, choose one of these processing types from the drop-down:

|

|

|

Bank Account Details |

Routing Number |

The bank routing number of the merchant account used to fund the sub-merchant. |

|

Account Number |

The bank account number of the merchant account used to fund the sub-merchant. |

|

|

Primary Contact (Operations) |

First Name |

(Required field) The name of the primary operational contact for this sub-merchant location (not necessarily the person who executes the legal contract). A contact name is required to register the sub-merchant with the card brands. |

|

Email Address |

(Required field) The email address of the primary operational contact for this sub-merchant. |

|

|

Contact Phone |

(Required field) The phone number of the primary operational contact for this sub-merchant, without dashes. |

|

|

Legal Entity (Applicable for Background checks)

|

EIN/Tax ID |

(Required field) The Tax ID (or EIN, if applicable) of the legal entity controlling this sub-merchant, without dashes or hyphens. If the entityType is Individual/Sole Proprietorship and a Tax ID is not available, include the principal owner's 9-digit Social Security Number in this element. Do not enter dashes. Note that when the Legal Entity is in Manual Review or Retry state, a message is displayed above this field. |

|

Name |

The name of the legal entity controlling this sub-merchant, as shown in the incorporation documents. Enter the name of the person in the case of a sole proprietorship. |

|

|

Type |

The business type of the legal entity:

|

|

|

Ownership Type |

The type of ownership of the legal entity, either Public or Private. |

|

|

Doing Business As |

The alternate name of the legal entity. |

|

|

Contact Phone |

The contact phone (land line) of the legal entity or principal owner/officer, without dashes. |

|

|

Address (includes Street Address 1 & 2, City, State/Province, Postal Code, and Country Code) |

The address of the legal entity controlling this sub-merchant. |

|

|

Annual Credit Card Sales Volume |

The approximate annual credit card sales expected to process under this legal entity/Tax ID, in USD. If there are multiple merchants for this Tax ID, enter the approximate total amount for all merchants under this Tax ID. |

|

|

Years in Business |

The number of years this legal entity has been operating. |

|

|

Accepted Credit Cards in the Past |

Indicates whether the Legal Entity has accepted credits cards in the past (Yes or No). |

|

|

PCI Level |

Indicates the PCI (Payment Card Industry) level, based on the number of card transactions a business processes annually:

|

|

|

Principal Owner (Applicable for Background checks) Note: Enter additional Principal Owners by clicking the Add Principal button at the bottom of the page. |

First Name Last Name |

The name of this legal entity principal owner/officer. Enter the Controlling Principal owner/officer first (For a definition, see Creating a New Legal Entity Request), followed by other beneficial owners using the Add Principal button. |

|

Title |

The title of this Legal Entity principal owner/officer. This field is required if you plan to board Amex OptBlue sub-merchants. If you do not enter a value in this field, the default title of ‘Principal’ is automatically added. |

|

|

SSN |

The social security number of this principal owner/officer for the legal entity. This field is required when the legal entity is considered non-exempt. It is optional when the legal entity type is ‘Individual/Sole Proprietorship.’ Enter only 9 digits for U.S. Social Security Numbers. Do not enter dashes/hyphens. |

|

|

Date of Birth |

(Required field) The date of birth of this principal owner/officer for the legal entity (mm/dd/yyyy). Important: The system validates the value for this element and generates an error for any of the following conditions:

-- Date indicates age less than 18 years -- Date indicates age greater than 125 years. |

|

|

Stake Percent |

(Required field) The percentage of ownership this principal has in your organization. The value can be from 0 to 100%. |

|

|

Address (includes Street Address 1 & 2, City, State/Province, Postal Code, and Country) |

The address of the of this principal owner/officer for the legal entity. P.O. boxes are not allowed. The Country field is required. |

|

|

Email Address |

The email address of this principal owner/officer for the legal entity. |

|

|

Contact Phone |

The contact phone of this principal owner/officer for the legal entity, without dashes. |

|

|

Driver’s License |

The driver's license number of this principal owner/officer for the legal entity. |

|

|

Driver’s License State |

The state that issued the driver's license of this legal entity principal owner/officer. |